Property taxes in Clermont County, Ohio, are based on the assessed value of your property. If you believe that your property has been incorrectly valued, it is important to act promptly. Challenging an incorrect property value can lead to significant tax savings. This guide explains how Clermont County homeowners can contest a property assessment, the process involved, and tips for a successful appeal.

Understanding Property Assessments in Clermont County

The Clermont County Auditor determines the value of all real estate for tax purposes. This valuation is supposed to reflect the fair market value of the property. Factors that affect property assessments include:

- Location: Proximity to schools, shopping centers, and other amenities

- Property Size: Land and building dimensions

- Property Condition: Age, maintenance, renovations, or structural issues

- Market Trends: Recent sales in the neighborhood

Sometimes, the assessed value may not reflect current market conditions, or there may be errors in the property record. Identifying these discrepancies is the first step in challenging your property value.

Common Reasons to Challenge a Property Value

Homeowners often contest their property value for the following reasons:

- Overvaluation: Property assessed higher than market value

- Clerical Errors: Incorrect square footage, number of rooms, or lot size

- Property Damage: Recent damage that affects value but isn’t reflected in assessment

- Comparable Sales: Neighboring properties with similar features are valued lower

- Zoning Issues: Misclassification of property type or use

Step-by-Step Guide to Challenging Your Property Value

Challenging a property assessment involves several steps. Follow this guide to ensure your appeal is properly submitted.

Step 1: Review Your Property Record

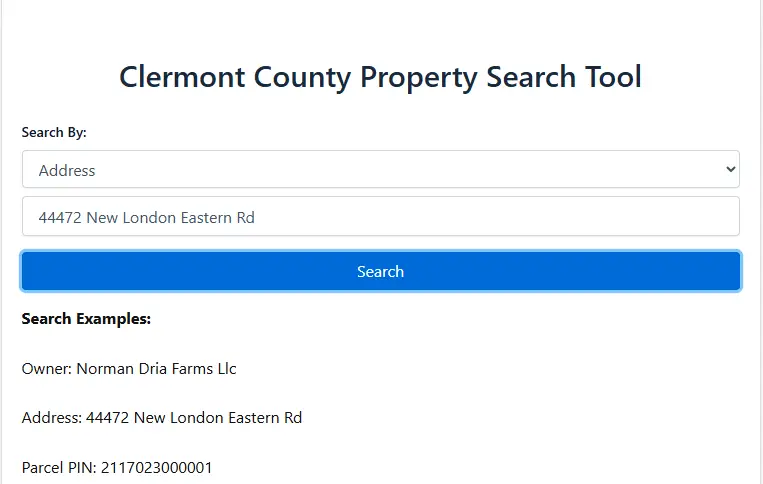

- Access your property record card from the Clermont County Auditor’s website.

- Check details such as:

- Square footage

- Number of rooms and bathrooms

- Land size and zoning classification

- Identify any inaccuracies that may support your case.

Step 2: Collect Supporting Evidence

Evidence is critical to successfully contest your property value. Useful evidence includes:

- Recent comparable property sales in your area

- Professional appraisal reports

- Photos of structural issues or damages

- Records of renovations or home improvements

Step 3: Contact the Clermont County Auditor

- Before filing a formal appeal, consider discussing your concerns with the auditor’s office.

- Sometimes minor errors can be corrected without filing a formal appeal.

Step 4: File a Formal Appeal

If the issue is not resolved informally, you can file a formal appeal:

- Complete the Board of Revision (BOR) complaint form provided by the Clermont County Auditor.

- Include all supporting documentation.

- Submit the appeal before the annual March 31 deadline.

Step 5: Attend the Hearing

- The Board of Revision will schedule a hearing.

- Present your evidence clearly and professionally.

- Be prepared to answer questions from the board or the auditor’s representative.

Step 6: Receive the Decision

- The BOR will issue a written decision.

- If unsatisfied, you can further appeal to the Ohio Board of Tax Appeals (BTA).

Tips for a Successful Property Value Challenge

- Act Quickly: Don’t wait until the last minute; missed deadlines may void your appeal.

- Use Clear Evidence: Strong documentation like appraisals and comparable sales is more persuasive than opinion.

- Be Professional: Present your case logically and respectfully.

- Track Changes: Keep records of any communication with the auditor or board.

- Consider a Consultant: Property tax consultants or attorneys can provide valuable guidance.

Common Mistakes to Avoid

- Missing Deadlines: Late appeals are usually rejected.

- Weak Evidence: Unsupported claims rarely succeed.

- Ignoring Comparable Sales: Always include relevant neighborhood data.

- Relying on Personal Opinion: Objective data is necessary.

- Failing to Check Auditor Records: Errors on your property record can support your case.

Sample Table: Property Value Comparison

| Property Address | Assessed Value | Market Value | Notes |

|---|---|---|---|

| 123 Maple St | $270,000 | $250,000 | Overvalued compared to comps |

| 456 Oak Ave | $280,000 | $260,000 | Larger lot, similar home |

| 789 Pine Dr | $265,000 | $245,000 | Minor structural issues |

Conclusion

Challenging an incorrect property value in Clermont County can significantly reduce your property taxes if successful. By reviewing your property record, gathering strong evidence, filing a timely appeal, and attending the hearing, homeowners can ensure their property is fairly assessed. Being proactive and organized is key to a successful challenge.

FAQs

How do I know if my property value is incorrect?

Compare your property’s assessed value with recent sales of similar properties in your area and check for any errors on your property record.

What is the deadline to file a property value appeal in Clermont County?

Appeals to the Board of Revision must typically be filed by March 31 of the year following your tax valuation notice.

Can I appeal without professional help?

Yes, homeowners can file appeals independently, but a property tax consultant or attorney may improve your chances in complex cases.

What evidence is most effective for an appeal?

Recent comparable sales, professional appraisals, property damage records, and photographs of the property are the strongest evidence.

Can I further appeal if the Board of Revision denies my appeal?

Yes, if you disagree with the BOR decision, you can appeal to the Ohio Board of Tax Appeals (BTA).