If you believe your property in Clermont County, Ohio, is overvalued for tax purposes, you have the right to appeal. Property taxes are based on the assessed value of your home, and ensuring that this valuation is fair can save you significant money. This guide provides step-by-step instructions on how to file a property valuation appeal in Clermont County through the Board of Tax Appeals (BTA).

Understanding Property Valuation in Clermont County

Before filing an appeal, it’s essential to understand how your property is assessed. The Clermont County Auditor determines the fair market value of your property, which forms the basis for your property taxes. Factors that affect property valuation include:

- Location: Proximity to amenities, schools, and commercial areas

- Property Size: Land and building size

- Condition: Age, renovations, and structural condition

- Market Trends: Comparable sales in your neighborhood

It’s common for homeowners to feel their property is overvalued. If your property value seems inaccurate compared to similar properties nearby, a valuation appeal may be appropriate.

When a Property Valuation Appeal Is Most Appropriate

Filing an appeal is generally most effective when there is clear evidence that your assessed value exceeds recent comparable sales, contains factual errors, or does not reflect property condition issues present on the valuation date.

What is the Board of Tax Appeals (BTA)?

The Board of Tax Appeals (BTA) is a state-level entity in Ohio that hears disputes regarding property valuations, real estate taxes, and exemptions. If you disagree with the valuation determined by the Clermont County Auditor, the BTA provides a formal avenue for resolution.

Key Points About BTA

- The BTA is independent of the county auditor’s office.

- It reviews evidence submitted by both the property owner and the auditor.

- Decisions are legally binding but can be further appealed to Ohio courts.

Step-by-Step Guide to Filing a Property Valuation Appeal

Filing an appeal may seem complicated, but following these steps carefully will improve your chances of success.

Step 1: Review Your Property Valuation

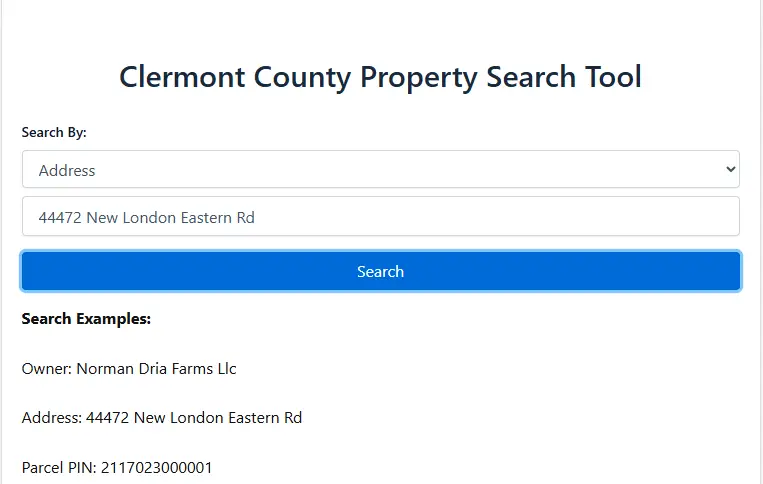

- Obtain a copy of your property record card from the Clermont County Auditor’s website.

- Compare your property’s assessed value to similar properties in your area.

- Take note of any discrepancies or factors that may justify a lower valuation.

Step 2: Gather Evidence

Evidence is critical for a successful appeal. Useful evidence includes:

- Recent comparable sales in your neighborhood

- Appraisal reports conducted by licensed appraisers

- Photographs showing structural or maintenance issues

- Records of home improvements or damages that may affect value

Step 3: File a Notice of Appeal

- Complete the BTA complaint form, available on the Ohio Board of Tax Appeals website.

- Ensure your form includes:

- Property address and parcel number

- Assessed value being appealed

- Reason for appeal

- Supporting evidence

- Deadline: Appeals must typically be filed by March 31 of the year following the tax valuation notice. Always verify the exact date for the current tax year.

Filing deadlines are strictly enforced. Late or incomplete appeals are typically dismissed without review, regardless of merit.

Step 4: Submit Your Appeal

- Appeals can be submitted online, by mail, or in person to the BTA office.

- Keep copies of all submitted documents for your records.

- Pay any required filing fees, if applicable.

Step 5: Attend the Hearing

- After your submission, the BTA will schedule a hearing.

- Present your evidence clearly and professionally.

- Be prepared to answer questions from the BTA panel or the auditor’s representative.

Step 6: Receive the Decision

- The BTA will issue a written decision, which may:

- Adjust the property value

- Confirm the auditor’s valuation

- Provide guidance for further appeals if necessary

If the valuation is reduced, the adjustment may apply to the current or future tax year depending on the timing of the decision. Any tax refund or adjustment is processed through the county, not directly by the BTA.

Tips for a Successful Appeal

- Start early: Don’t wait until the last minute to prepare evidence.

- Focus on data: Concrete data like recent sales or appraisal reports carry more weight than personal opinions.

- Be professional: Present your case respectfully and logically.

- Consider hiring a professional: Experienced property tax consultants or attorneys can help strengthen your case.

Common Mistakes to Avoid

- Missing deadlines: Late appeals are typically rejected.

- Weak evidence: Unsupported claims rarely succeed.

- Ignoring comparable sales: Always include neighborhood sales for reference.

- Assuming all values are negotiable: Some aspects, like zoning or lot size, may not be disputable.

- Not reviewing the auditor’s records: Errors on your property card can provide strong grounds for appeal.

Comparable Property Evidence

| Property Address | Sale Price | Size (sq ft) | Year Built | Assessed Value | Notes |

|---|---|---|---|---|---|

| 123 Maple St | $250,000 | 2,000 | 1995 | $270,000 | Similar style home |

| 456 Oak Ave | $260,000 | 2,100 | 1997 | $280,000 | Larger lot |

| 789 Pine Dr | $245,000 | 1,950 | 1994 | $265,000 | Minor structural issues |

Example data shown is for illustrative purposes only. Actual comparable sales and assessed values will vary by location, property condition, and tax year.

Official appeal forms, procedural rules, and filing instructions are published by the Ohio Board of Tax Appeals and should always be reviewed before submitting an appeal.

Conclusion

Filing a property valuation appeal in Clermont County can reduce your property taxes if your property has been overvalued. By understanding the process, gathering accurate evidence, and presenting your case clearly, you can improve your chances of a successful outcome. Always follow deadlines and guidelines provided by the Clermont County Auditor and the Ohio Board of Tax Appeals.

FAQs

How do I know if I should appeal my property valuation?

If your property’s assessed value is higher than similar properties in your neighborhood or does not reflect current market conditions, an appeal may be warranted.

What is the deadline for filing a BTA appeal in Clermont County?

Typically, appeals must be filed by March 31 of the year following your property tax valuation notice, but always check the current year’s rules.

Can I file a property valuation appeal online?

Yes, the Ohio Board of Tax Appeals allows online submission, but appeals can also be submitted by mail or in person.

Do I need an attorney to file a property valuation appeal?

While not required, a property tax consultant or attorney can provide guidance, especially for complex cases.

What evidence is most effective for a successful appeal?

Recent comparable property sales, professional appraisals, and documentation of structural issues or damages are most persuasive.

Does filing an appeal freeze my property taxes?

No. Property taxes must still be paid as billed while an appeal is pending. Any adjustment or refund is handled after a final decision is issued.