Quick Answer:

Homeowners in Clermont County can reduce their property taxes by applying for exemptions like the Homestead Exemption, appealing over-assessed property values, claiming eligible credits, and staying informed about local tax levies. These legal options can lower taxable value and reduce annual tax bills.

Property taxes in Clermont County fund essential services like schools, emergency response, and infrastructure but high property tax bills can strain household budgets. Fortunately, Ohio law allows homeowners to legally reduce their Clermont County property taxes through exemptions, appeals, and strategic planning.

This guide explains seven proven ways to lower your property tax bill, including how to apply for exemptions, challenge over-assessed values, and avoid unnecessary penalties.

7 Legal Ways to Reduce Property Taxes in Clermont County

1. Apply for the Homestead Exemption

The Homestead Exemption reduces the taxable value of your primary residence. Eligible homeowners, particularly seniors and disabled residents, can see significant reductions in their annual property taxes.

To apply:

- Ensure the property is your primary residence

- Meet age or disability criteria

- Submit an application to the Clermont County Auditor with the required documentation

Once approved, the exemption automatically reduces your taxable value, lowering your annual bill.

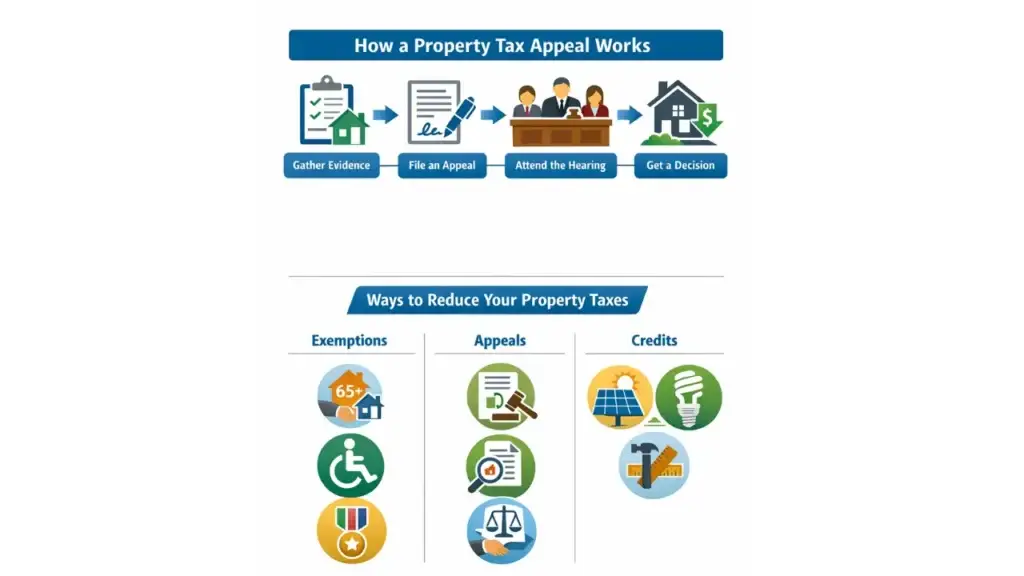

2. Check for Additional Property Tax Exemptions

Besides the Homestead Exemption, Clermont County offers other exemptions that may apply to you:

- Senior Citizen Exemption – for residents over a certain age

- Disability Exemption – for homeowners with qualifying disabilities

- Veteran or Surviving Spouse Exemption – for eligible military veterans or spouses

Each exemption reduces the taxable value of your property, either partially or fully, depending on eligibility.

3. Review Your Property’s Assessed Value

Property taxes are based on the assessed value of your home. Sometimes, assessments can be inaccurate, overstated, or outdated.

- Review the Clermont County Auditor’s property records

- Compare your assessment to similar homes in your neighborhood

- If your assessed value seems too high, you can file a formal valuation appeal

Correcting an over-assessed value can result in lower property taxes for multiple years.

4. File a Property Tax Appeal

If you believe your property is overvalued, you can appeal the valuation with the county.

The appeal process includes:

- Gathering evidence, such as recent sales of comparable properties

- Submitting a formal request to the Clermont County Board of Revision

- Attending a hearing if required

A successful appeal reduces your assessed value, which directly lowers your annual tax bill.

5.Claim Credits for Energy Efficiency or Renovations

Certain home improvements can qualify for property tax credits or exemptions. Examples may include:

- Solar panels

- Energy-efficient appliances

- Home renovations approved under local incentive programs

These credits may not eliminate your taxes but can significantly reduce the amount owed.

6.Take Advantage of Property Tax Payment Timing

Some homeowners can reduce penalties and interest by strategically paying property taxes on time or early:

- Pay by the official due date to avoid late penalties

- If eligible, use installment plans offered by the Clermont County Treasurer

- Ensure your mortgage escrow account handles payments correctly

Timely payments prevent unnecessary costs that increase your effective property tax burden.

7. Stay Informed About Local Levies and Elections

Voter-approved levies for schools, fire districts, and public services directly impact your tax bill. Being informed helps you:

- Understand upcoming tax increases

- Participate in local decisions

- Plan your budget according to potential changes in rates

Staying engaged can help you anticipate and manage tax fluctuations rather than facing unexpected increases.

Additional Tips for Lowering Your Property Taxes

- Keep detailed records of all exemptions and appeals

- Review your annual property tax statement for accuracy

- Contact the Auditor or Treasurer if you notice errors or overcharges

- Consult with a tax professional if managing multiple properties

Proactive management helps maximize savings and ensures your tax bill reflects your actual obligations.

Conclusion

Reducing property taxes in Clermont County is possible when you understand the tools and exemptions available. From applying for the Homestead Exemption to filing appeals and taking advantage of tax credits, homeowners have multiple ways to legally lower their tax bills. Staying informed, reviewing assessments, and acting promptly are key strategies to manage costs effectively.

By following these seven strategies, Clermont County property owners can reduce financial burdens and better plan for annual property tax obligations.

Frequently Asked Questions

Who qualifies for the Homestead Exemption in Clermont County?

Homeowners must occupy the property as their primary residence and meet age, disability, or other specific criteria set by the county.

Can I appeal my property assessment if I think it’s too high?

Yes. You can file an appeal with the Clermont County Board of Revision and present evidence that your property is overvalued.

Are there property tax credits for energy-efficient upgrades?

Some improvements, such as solar panels or approved energy-efficient renovations, may qualify for property tax credits or exemptions.

How can I stay informed about changes to my property taxes?

Check the Clermont County Auditor’s and Treasurer’s websites regularly and monitor local elections for new levies.

Does paying taxes early reduce my property bill?

Paying early does not lower the tax amount but prevents penalties and interest that increase your overall cost if payments are late.